Ecommerce in Ireland: Must-Know Stats and Numbers (2022) – In this article I am looking at stats and numbers of the Ecommerce industry in Ireland in 2022.

By reading you will learn a basic definition of ecommerce, how big is ecommerce in Ireland, what the main ecommerce players are, and much more.

If you like this article, please make sure you also check:

If you need help with increasing your online sales, please feel free to check out our PPC success stories and services.

Ecommerce in Ireland: General Questions

In this section I am covering some basic questions about ecommerce.

By reading this section you will get an understanding about ecommerce, ecommerce websites, online sales and purchases.

What is Ecommerce?

Ecommerce, or E-commerce, stands for ‘electronic commerce’ and is the activity of buying or selling products or services, making or receiving payments directly over the internet.

What is an Ecommerce Website, Store or Shop?

An ecommerce website, store or shop is a website where people can directly buy or sell products or services or make and receive payments.

What is an Online Sale?

An online sale is a transaction for the selling of products or services that happens over the internet, generally through a website or app.

What is an Online Purchase?

An online purchase is a transaction for the buying of products or services that happens over the internet, generally through a website or app.

Ecommerce in Ireland: Revenue

In this section, I am including a number of stats, numbers and charts about revenue from ecommerce in Ireland.

By reading this section you will discover the overall size of ecommerce in Ireland, the average revenue by user, the split between domestic vs cross-border revenue, the split between online vs offline and desktop vs mobile devices.

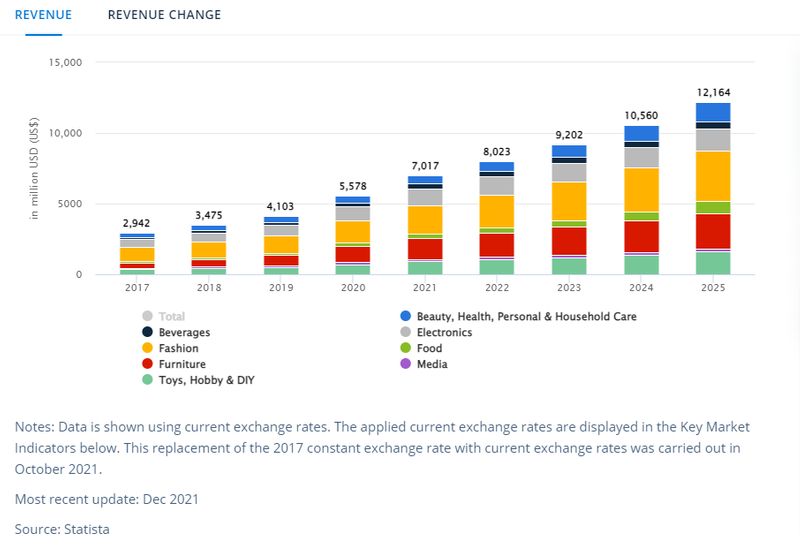

Ecommerce Revenue in Ireland (Market Value by Industry)

Ecommerce revenue and market size in Ireland reached $7,017m / €6,289 in 2021. This was a 25% increase on 2020 year-on-year.

Fashion represented the largest portion of the revenue, followed by Furniture and Electronics.

Below you can find the revenue split by industry (in descending order):

- Fashion – $2,031m / €1,865m

- Furniture – $1,500m / €1,344m

- Electronics – $1,208m / €1,082m

- Toys & DIY – $921m / €825m

- Beauty – $599m / €536m

- Beverages – $327m / €293m

- Food – $269m / €241m

- Media – $163m / €146

The projection for 2022 is for a total of $8,023m / €7,190m total ecommerce revenue.

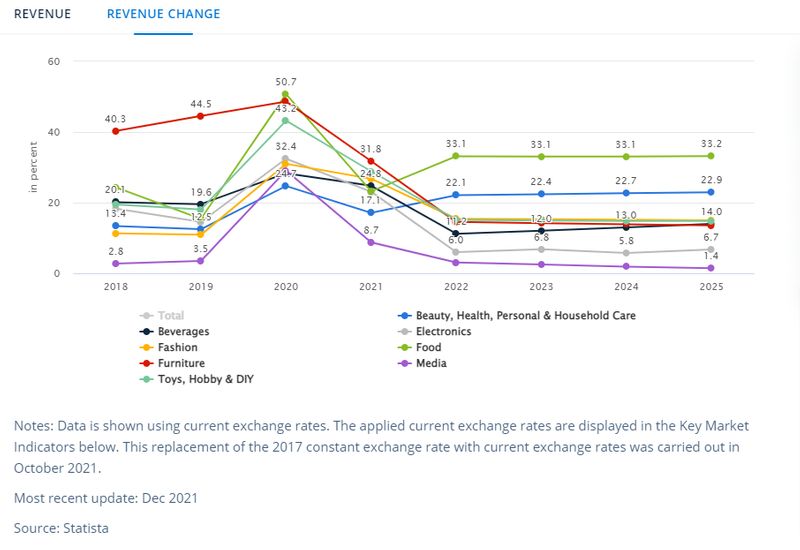

Ecommerce Revenue Change by Industry (2021)

The highest growth in ecommerce revenue in Ireland in 2021 came from the Furniture industry with a 31.8% increase, followed by Toys & DIY with 28.9% and Fashion with 26.8%.

Below you can find the revenue increase in 2021 year-on-year by industry (in descending order):

- Furniture – 31.8%

- Toys & DIY – 28.9%

- Fashion – 26.8%

- Beverages – 24.6%

- Food – 23.2%

- Electronics – 23.1%

- Beauty – 17.1%

- Media – 8.7%

The growth projection for 2022 in Ireland shows Food at 33.1% increase, followed by Beauty at 22.1%.

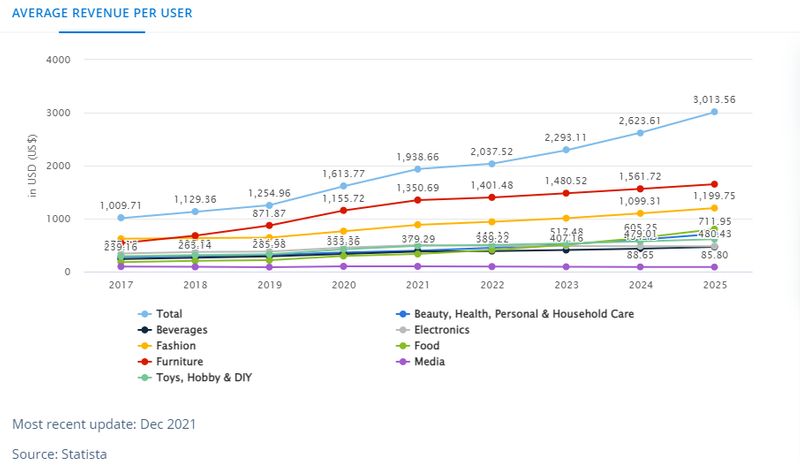

Average Ecommerce Revenue Per User in Ireland by Industry

The average ecommerce revenue per user in Ireland in 2021 reached $1,936 / €1,717 with a 20% year-on-year.

The average ecommerce revenue per user varied from $1,350.69 for the Furniture industry to $98.43 for the Media industry.

Below you can find the average ecommerce revenue per user in Ireland by industry (in descending order):

- Furniture – $1,350 / €1,209

- Fashion – $885 / €793

- Electronics – $501 / €449

- Toys & DIY – $485 / €434

- Beauty – $394 / €353

- Beverages – $379 / €339

- Food – $332 / €297

- Media – $98 / €87

The projection for 2022 is for the average ecommerce revenue per user to increase to $1,401 / €1,255 for the Furniture industry, followed by Fashion to $939 / €841.

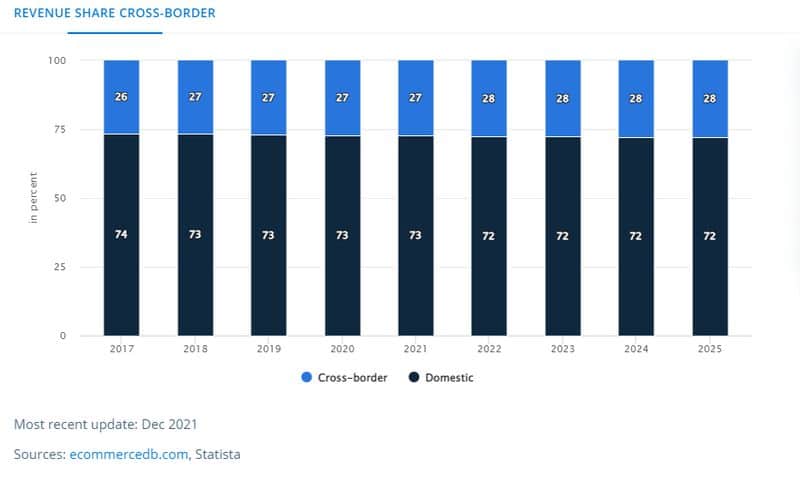

Ecommerce Revenue Share Domestic v Cross-Border

Cross-border spend has been a key feature of the Irish ecommerce landscape:

Ireland has the highest rate of cross-border shoppers in Western Europe, with 84 percent of online shoppers making purchases from overseas((Unknown, E-commerce Payment Trends: Ireland, jpmorgan.com, 2019)).

The split between Domestic and Cross-Border ecommerce revenue has been fairly consistent throughout the years and 2021 was no exception.

A similar split is expected to pan out in 2022.

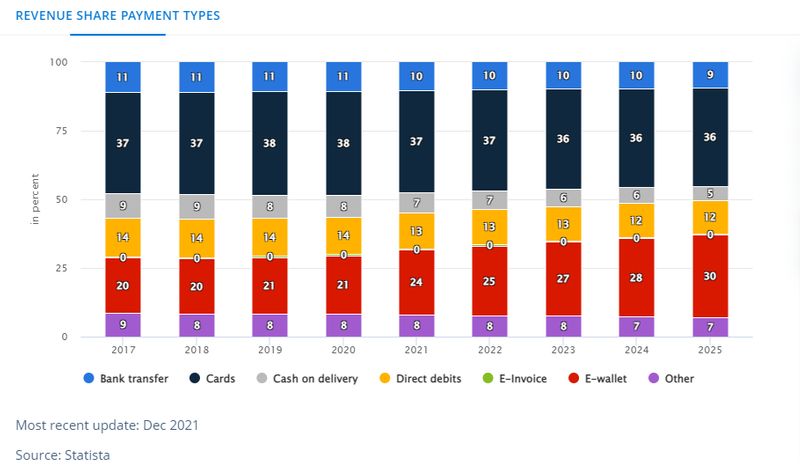

Revenue Share by Payment Types

In 2021, 37% or the majority of users made online purchases by using their credit or debit card. Having said that:

The fastest-growing payment methods are considered to be digital wallets and bank transfers, both of which are poised to grow at a compound annual growth rate of 15 percent out to 2021((Unknown, E-commerce Payment Trends: Ireland, jpmorgan.com, 2019)).

Similarly, digital wallet as a form of payment are expected to grow to representing 25% of the total number of ecommerce transactions in Ireland.

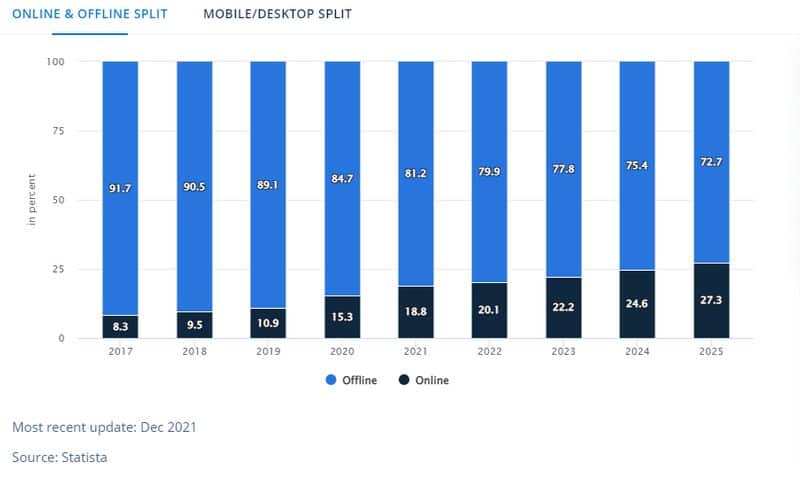

Online vs Offline Revenue Split

While consistently growing throughout the years, revenue from online sales only represented 18.8% of the total sales in 2021.

This percentage is expected to grow to 20.1% in 2022 with a projected 27.3% of revenue coming from online sales in 2025.

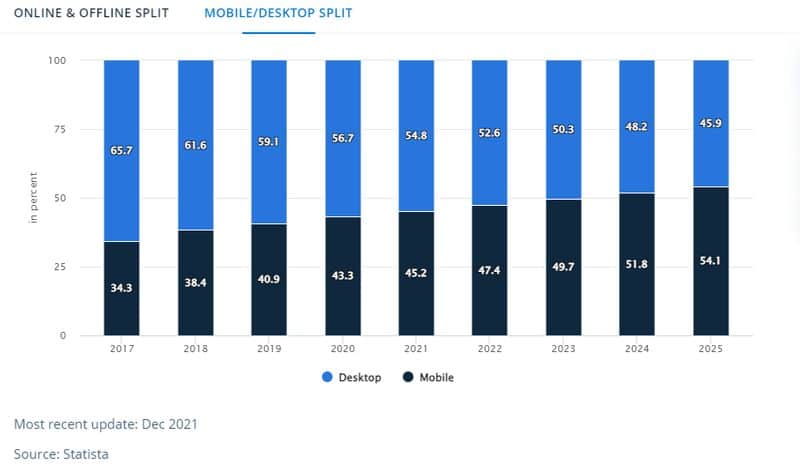

Mobile vs Desktop Split

Desktop was still the preferred device for making an online purchase in 2021 representing 54.8% of the total online sales versus 45.2% from mobile.

Having said that, mobile keeps growing year-on-year. It is expected to reach 47.4% in 2022 and to surpass desktop as a preferred device for online transactions in 2024:

Currently worth €2.9 billion,31 the mobile commerce market is projected to expand at a compound annual growth rate of 12 percent out to 202132 to potentially become a €4.6 billion industry((Unknown, E-commerce Payment Trends: Ireland, jpmorgan.com, 2019)).

Ecommerce in Ireland: Demographics

In this section you will find details about the demographics engaging with ecommerce in Ireland.

By reading you will discover what ecommerce in Ireland looks like as far as users by industry, their penetration rate by industry, their age, gender and income.

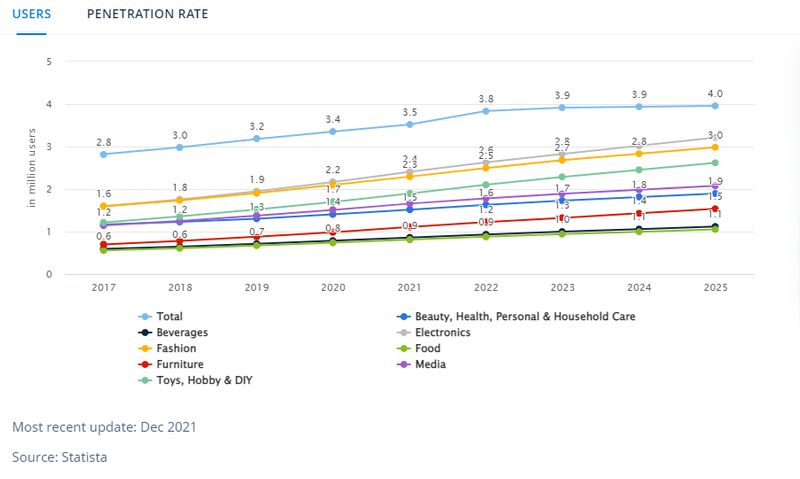

Ecommerce Users by Industry

There were a total of 3.4 million users in Ireland in 2021 for a 3% increase on 2020.

The majority of ecommerce users in Ireland in 2021 or 2.4m was found in the Electronics industry, followed by Fashion with 2.3m.

Below you can find the total number of ecommerce users in Ireland in 2021 by industry (in descending order):

- Electronics – 2.4m

- Fashion – 2.3m

- Toys & DIY – 1.9m

- Media – 1.7m

- Beauty – 1.5m

- Furniture – 1.1m

- Beverages – 0.9m

- Food – 0.8m

The total number of ecommerce users in Ireland is expected to grow to 3.5m in 2022.

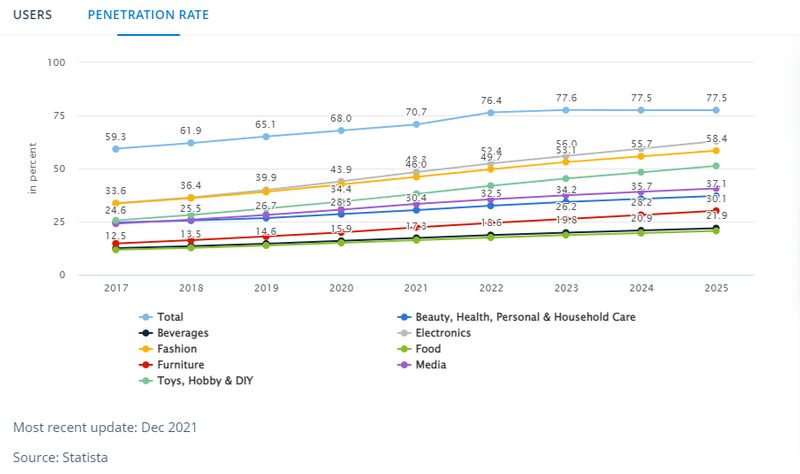

Ecommerce Users Penetration Rate by Industry

The ecommerce penetration rate in Ireland in 2021 was 70.7%, a 2.7 point increase on 2020.

Electronics has the highest penetration percentage among Irish users in 2021 with 48.3%, followed by Fashion with 46%.

Below you can find the penetration percentage of ecommerce users in Ireland in 2021 by industry (in descending order):

- Electronics – 48.3%

- Fashion – 46%

- Toys & DIY – 38.1%

- Media – 33.3%

- Beauty – 30.4%

- Furniture – 22.3%

- Beverages – 17.3%

- Food – 17.3%

In 2022 the penetration rate of ecommerce users in Ireland is expected to reach 76.4%.

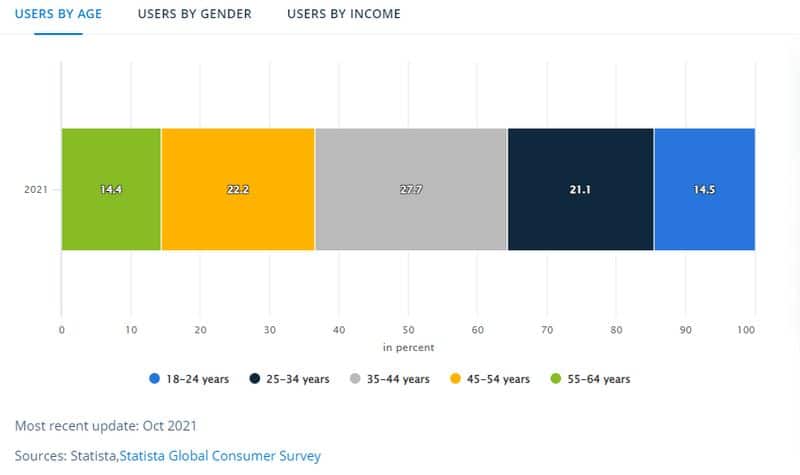

Ecommerce Users by Age

The majority of ecommerce users in Ireland is made up of 35-44 years old with 27.7%, followed by 45-54 years old with 22.2% and 25-34 years old with 21.1%.

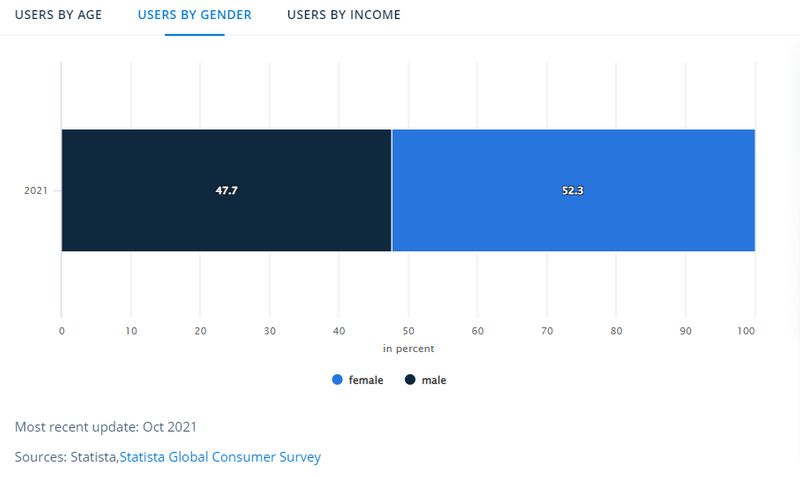

Ecommerce Users by Gender

Female ecommerce users are predominant in Ireland with 52.3%.

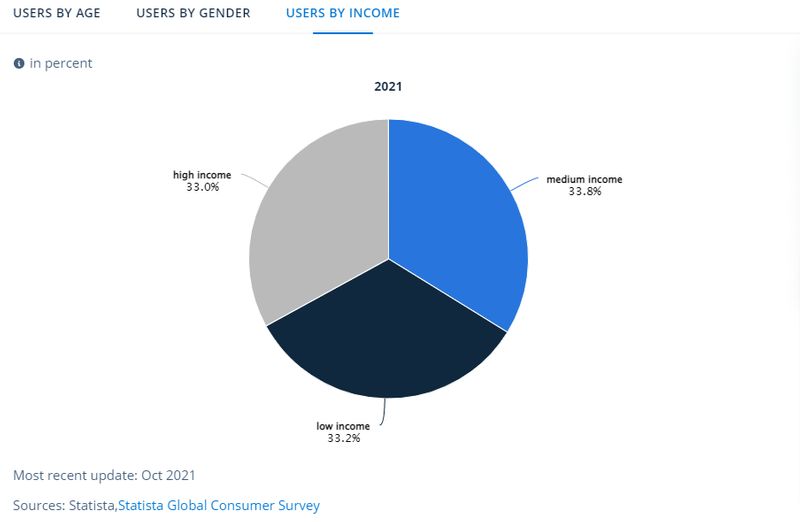

Ecommerce Users by Income

The income of ecommerce users in Ireland is almost evenly split among low, medium and high-income, all groups representing around 33% of the ecommerce population in Ireland.

Ecommerce in Ireland: Enterprises

In this section I look at ecommerce in Ireland from the perspective of Irish enterprises.

By reading this section about ecommerce in Ireland you will find answers to:

- Ecommerce sales and purchases by enterprise size

- Ecommerce sales and purchases by enterprise sector

- Location of ecommerce sales by enterprise sector

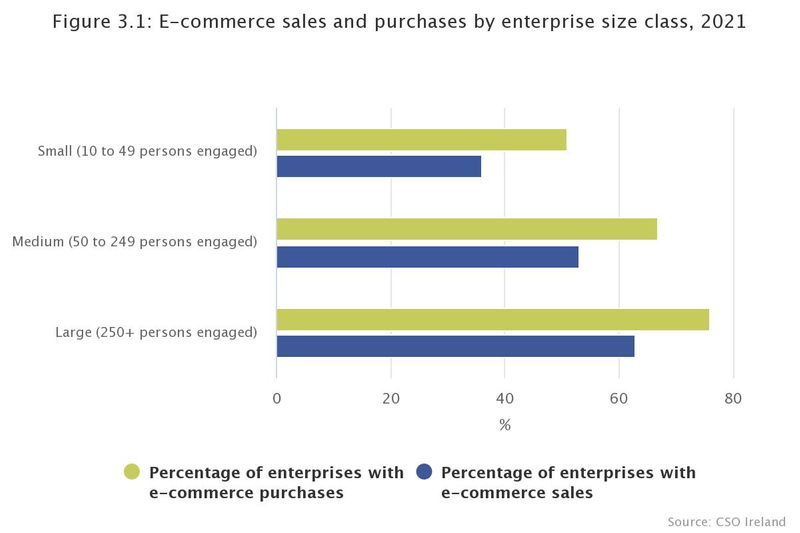

Ecommerce in Ireland: Sales and Purchases by Enterprise Size Class in Ireland in 2021

In 2021, 40% of Irish enterprises had at least one ecommerce sale:

Large enterprises, those with 250 or persons engaged, had the highest proportion of enterprises with e-commerce sales at 63%. This compares with 53% of medium sized firms (50-249 persons engaged) and 36% of small businesses (10-49 persons engaged).

More than half (54%) of enterprises made purchases over computer networks in 2021. Three quarters (76%) of larger enterprises made e-commerce purchases in 2021 while 67% of medium sized firms and more than half (51%) of small businesses did so((Unknown, Information Society Statistics Enterprises 2021, cso.ie)).

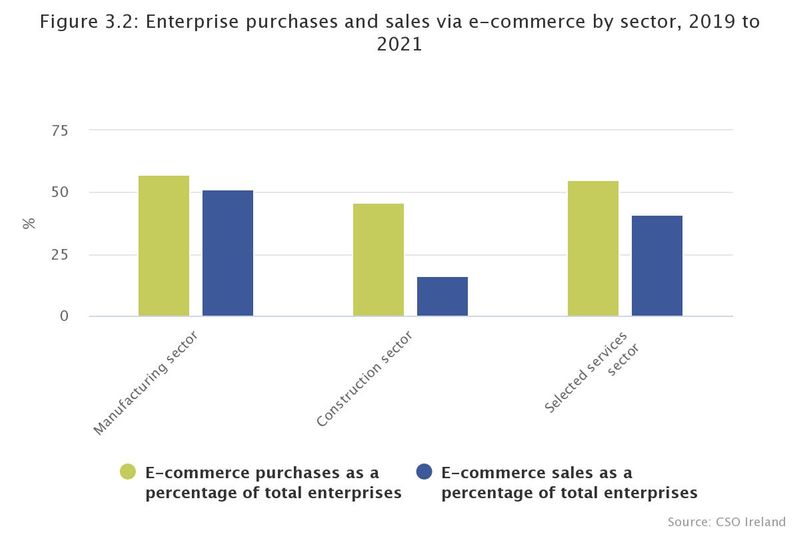

Ecommerce in Ireland: Sales and Purchases by Enterprise Sector in Ireland in 2021

57% of Manufacturing enterprises in Ireland made at least one purchase by website, app or Electronic Data Interchange (EDI) in 2021.

This compares with 55% from the Services sector and 46% from the Construction one.

More than 51% of Manufacturing enterprises conducted sales via web, app or EDI in 2021.

This compares with 41% from the Services sector and 16% from the Construction one.

Ecommerce in Ireland: Location of Ecommerce Sales by Enterprise Sector (2021)

33% of enterprises received orders via website or apps from customers located in Ireland in 2021. 10% firms received orders online from customers located in the other countries in the European Union (EU) which in 2021 excluded the United Kingdom (UK). 11% of enterprises received orders from customers located in the rest of the world, which includes the UK.

Ecommerce in Ireland: Conclusions

I hope you like this article about ecommerce in Ireland. If you have any suggestions on how to improve it, please feel free to share your thoughts in the comments below.

Featured image by Andy Hermawan on Unspash.com.