UK and Northern Ireland VAT Rates in Woocommerce – In this article, I am showing you a step-by-step guide on how to set up UK and Northern Ireland VAT rates in Woocommerce.

By reading this post, you will learn what Value Added Tax (VAT) is, why you should register, what changed with Brexit for UK and Northern Ireland and ultimately how to set up UK and Northern Ireland VAT rates in Woocommerce.

How to Set Up UK and Northern Ireland VAT in Woocommerce: General Questions

What is VAT?

VAT, which stands for Value Added Tax, is a tax on the selling of goods and services within the EU.

The rate or percentage of the VAT varies depending on:

- The concerning member state

- The type of goods and services

What is Brexit?

Brexit, which stands for ‘British Exit’, refers to the withdrawal of the United Kingdom (UK) from the European Union (EU). Followed a referendum, the UK is not an EU member starting from January 1st, 2021.

Woocommerce VAT and Brexit

One of the most important changes coming from Brexit affected the selling of goods to the UK and Northern Ireland.

In brief, if you have an ecommerce website selling goods to the UK, you need to be aware of the following (source: Woocommerce.com((Ready for Brexit: a Guide for Woocommerce Store Owners, Woocommerce.com))):

- All imported goods will now be subject to VAT at the point of sale, rather than the point of importation.

- For orders below £135, merchants need to collect sales (supply) VAT instead of import VAT. This is charged to the UK consumer at the point of sale, which in this case, would be your WooCommerce store. As the merchant, you’ll need to report and pay the collected VAT through a regular UK VAT return. This replaces import VAT collection at the clearance by customs, or import payments to the delivery provider.

- For orders above £135, the existing import VAT procedures will be used. You have the choice as the merchant to pay for import VAT and duties on clearance and reclaim it if you have a UK VAT number. Alternatively, you can let your customer pay at customs or to the delivery service.

Woocommerce VAT and Northern Ireland

Northern Ireland is a territory within the UK. As such, the Woocommerce VAT rate you set up for the UK will apply.

However, if you are selling goods from the EU to Northern Ireland you will need to charge the EU VAT rate rather than the UK one.

Let’s see how we can solve this.

How to Set Up UK and Northern Ireland Vat Rates in Woocommerce

In these two short guides you will learn how to apply the EU VAT rate to Northern Ireland, apply the correct VAT rate for UK orders below £135 and no VAT for UK orders above £135.

How to Set Up VAT for Northern Ireland in Woocommerce

To set up the EU VAT rate you will have to – literally – add Northern Ireland counties to Ireland. Here’s how to do it:

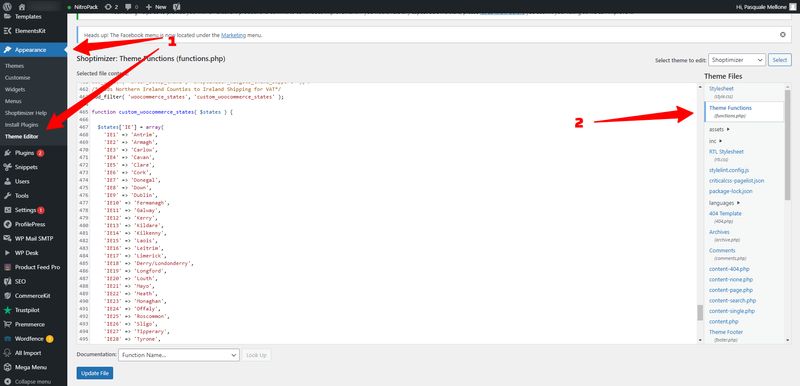

- From your WordPress admin dashboard, click on Appearance > Theme Editor

- Select the functions.php file

- Copy and paste this code at the bottom of the functions.php file (source: River.ie((Woocommerce VAT Rates Fix for the Island of Ireland, River.ie)))

/* UK and Northern Ireland VAT Rates in Woocommerce: Adds Northern Ireland Counties to Ireland Shipping for VAT*/

add_filter( 'woocommerce_states', 'custom_woocommerce_states' );

function custom_woocommerce_states( $states ) {

$states['IE'] = array(

'IE1' => 'Antrim',

'IE2' => 'Armagh',

'IE3' => 'Carlow',

'IE4' => 'Cavan',

'IE5' => 'Clare',

'IE6' => 'Cork',

'IE7' => 'Donegal',

'IE8' => 'Down',

'IE9' => 'Dublin',

'IE10' => 'Fermanagh',

'IE11' => 'Galway',

'IE12' => 'Kerry',

'IE13' => 'Kildare',

'IE14' => 'Kilkenny',

'IE15' => 'Laois',

'IE16' => 'Leitrim',

'IE17' => 'Limerick',

'IE18' => 'Derry/Londonderry',

'IE19' => 'Longford',

'IE20' => 'Louth',

'IE21' => 'Mayo',

'IE22' => 'Meath',

'IE23' => 'Monaghan',

'IE24' => 'Offaly',

'IE25' => 'Roscommon',

'IE26' => 'Sligo',

'IE27' => 'Tipperary',

'IE28' => 'Tyrone',

'IE29' => 'Waterford',

'IE30' => 'Westmeath',

'IE31' => 'Wexford',

'IE32' => 'Wicklow',

);

return $states;

}

How to Set Up VAT for the UK in Woocommerce

To set up the UK VAT rate you will have to put a conditional logic on whether the order is below or above £135. Here’s how to do it:

- From your WordPress admin dashboard, click on Appearance > Theme Editor

- Select the functions.php file

- Copy and paste this code at the bottom of the functions.php file (source: WordPress.org((Brexit UK VAT Collection, WordPress.org))):

function apply_uk_zero_tax_rate( $cart ) {

// UK and Northern Ireland VAT Rates in Woocommerce: UK VAT limit is 135 GBP; as of 2/11/2021, that's $186.25

$VAT_limit_UK = 186.25;

// UK and Northern Ireland VAT Rates in Woocommerce: get customer shipping location

$customer_country = WC()->customer->get_shipping_country();

// UK and Northern Ireland VAT Rates in Woocommerce: Loop through cart items to get cart subtotal

foreach ( $cart->get_cart() as $cart_item ) {

$subtotal += $cart_item['line_total'];

}

// UK and Northern Ireland VAT Rates in Woocommerce: Now check: If country <> GB (Great Britain), OR

// country = GB & cart subtotal less than 135£, THEN

// do nothing & keep standard tax rates

if ( ($customer_country != 'GB') || ( ($customer_country == 'GB') && ($subtotal < $VAT_limit_UK) ) )

return;

// Otherwise, loop through cart & set each item's tax rate to zero rate // (Note use of slug 'zero-rate', instead of name 'Zero rate') foreach ( $cart->get_cart() as $cart_item ) {

$cart_item['data']->set_tax_class( 'zero-rate' );

}

}

add_filter( 'woocommerce_before_calculate_totals', 'apply_uk_zero_tax_rate', 10, 1 );

add_filter( 'woocommerce_adjust_non_base_location_prices', '__return_false' );

Please note that in order to apply any VAT rate, you will have to first set a VAT rate per country in Woocommerce > Settings > Tax > Standard Rates.

Similarly, in order to apply no VAT to UK orders above £135 you will have to set a zero rate tax in Woocommerce > Settings > Tax > Zero Rate Rates.

To learn more about how to set up Taxes in Woocommerce, please check this post((Setting Up Taxes in Woocommerce, Woocommerce.com)).

I hope you liked this article about how to set up UK and Northern Ireland VAT in Woocommerce.

If you have any comment or you need help with your shop, please feel free to get in touch.

Appendix

Below you can find two easy to use explanatory tables about respectively UK taxes and Brexit and VAT Calculation in Northern Ireland (source: Shopify.com((UK Taxes and Brexit, Shopify.com))):

Table about UK Taxes and Brexit

[table id=35 /]

Table about VAT Calculation in Northern Ireland

[table id=36 /]